If the bedroom tax applies to you or the person you are looking after you should apply to your local council for a Discretionary Housing Payment. If you are of working age and are deemed to be.

Design Anthology Asia On Instagram Travel Boutique Hotel The Chow Kit Ormondhotels Pays Homage To The Richness And Glamou In 2020 Hotel Design Luxury Amenities

95 per month for two extra bedrooms.

Who pays bedroom tax. The bedroom tax means that working age people who get help towards their rent through Housing Benefit can have the amount they receive restricted if they are considered to have too many bedrooms. These taxes are often called local option transient rental taxes and are in addition to the 6 state. For example if you rent a private property with three bedrooms but under size criteria rules are only entitled to two bedrooms your benefit will be capped at the two bedroom rate for your area.

The bedroom tax affects how much of your rent can be covered by housing benefit or the universal credit housing element. Its proper name is the social sector size criteria but most people call it the bedroom tax. This is often referred to as the Bedroom Tax or the under-occupation penalty or the removal of the spare room subsidy.

Examples of people who may be affected include. The maximum rent that can be covered is reduced by. 86 if you have 1 spare room.

When the terms do not state who is liable the party to pay Stamp Duty will follow that as specified in the Third Schedule of the Stamp Duties Act. 14 will be taken off if you have one extra bedroom 25 will be taken off if you have two extra bedrooms. 5320 per month for one extra bedroom.

On a basic level Council Tax is paid by the occupant which is straightforward enough but in some instances this isnt the case. The rental agreement between the landlord and the tenant should set out the terms of the tenancy and one of the points addressed will be who pays the utility bills and council tax charges. Previously people in these circumstances could have been subject to the bedroom tax.

25 for two or more extra bedrooms. 14 for one extra bedroom. The bedroom tax applies to tenants in the social rented sector.

The ruling will restore full housing benefit to RR and at least 155 partners of disabled people who were also subjected to the bedroom tax before rules changed in 2017. You should also apply for a Discretionary Housing Payment if you are appealing a decision about needing an extra bedroom as an appeal can take some time and this will help you not to fall into rent arrears. Tenancy agreement to determine who is contractually required to pay the Stamp Duty.

If your rent is 100 a week the maximum benefit you get to help with rent is. 14 for 1 spare bedroom. Individual Florida counties may impose a local option tax on transient rental accommodations such as the tourist development tax convention development tax tourist impact tax or municipal resort tax.

So for example if your rent is currently 380 per month your benefit is cut by. Dubbed the bedroom tax Ciaran Jenkins explains how it works. While Council Tax is payable on all domestic properties across England and Wales the question of who foots the bill is a thorny one.

The primary instrument for establishing who pays the tax on a rental property is the lease. So if you have one spare bedroom and your rent is 100 per week only 86 will count when your housing benefit or UC housing costs are assessed. Couples or single working age people who live in a two-bed property families living in a three-bed or more property where children could share a bedroom.

The bedroom tax applies to tenants living in social housing - thats properties owned by the council or a housing association - claiming housing benefit. 25 for 2 or more spare bedrooms. Who pays Council Tax.

Check the terms of the document eg. If you have more bedrooms than the rules. Although the bedroom tax is specific to council and housing association tenants the size criteria rules are used to decide housing benefitUniversal Credit rates for private tenants.

Ad Explore Payroll Tools Other Technology Users Swear By - Start Now. Ad Explore Payroll Tools Other Technology Users Swear By - Start Now. Who has to pay.

The bedroom tax is a reduction in Housing Benefit for people who live in a property that is owned by NIHE or a housing association and that is too large for their household.

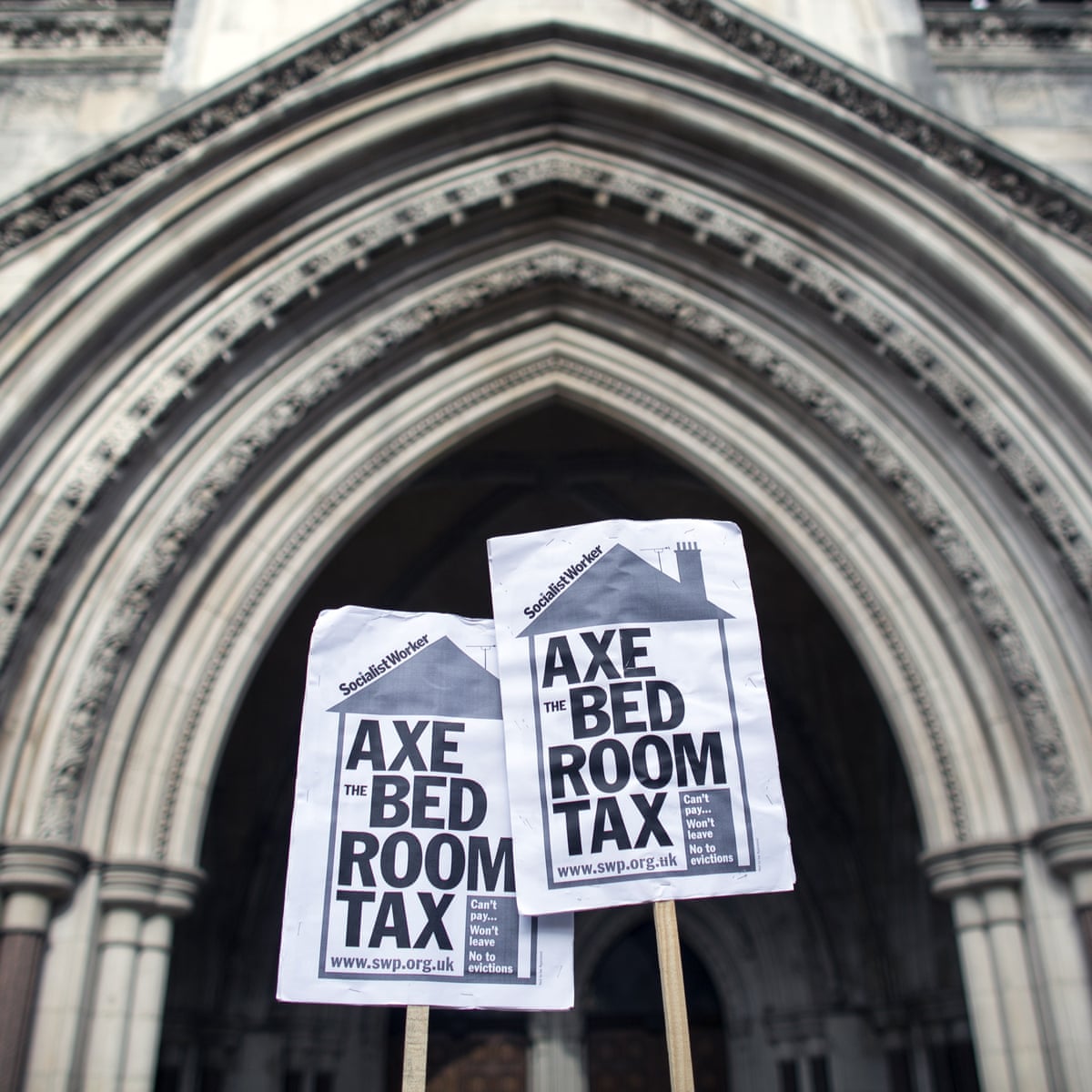

The Bedroom Tax Explained Bedroom Tax The Guardian

Self Catering Apartment Bedroom Contemporary Bedroom Sets Cool Bedroom Furniture Furniture

Mila Eye Stripe Rust Bed In A Bag Schatzi Brown White Bedding Master Bedroom Home Decor Bedding Master Bedroom

Consulting Firm Builds Lego Minifig Wall Project Nerd Lego Wall Lego People Lego Office

H H Studio Dubai Ottow By Gebruder Thonet Vienna Gmbh Gtv Bed Furniture Design Bed Furniture Bed

Green Cactus Upholstered Headboard Feng Shui Bedroom Bedroom Decor Home Decor

Financial Knowledge Archives Financial Freedom Website Home Buying Home Buying Tips Rent

Avoid These 5 Mistakes To Maximize Your Irs Tax Refund Tax Refund Saving Tips Irs Taxes

39 Simple Room Rental Agreement Templates Template Archive Room Rental Agreement Rental Agreement Templates Lease Agreement

Dreaming Architecture Space Room Floor Modern Simplicity Furniture New 2013 Cosy Warm Beautiful Bedrooms Master Beach House Bedroom Bedroom Design

Posh Tsukiji Ginza Lux Design Studio New Apartments For Rent In Chuō Ku Tōkyō To Japan In 2020

Guaranteed Rent Faqs This Or That Questions Property Management Rent

All Utahns Pay Taxes But The Poor Pay A Greater Percent Of Their Income Than The Rich Paying Taxes Family Income Income

15 Payslip Template Uk Excel Paystub Confirmation Microsoft Excel Tutorial Excel Shortcuts Excel

Which Countries Pay The Most Income Tax Infographic Income Tax Income Belgium Germany

Gallery Of Dodged House Leopold Banchini Daniel Zamarbide 17 Built In Furniture House Abandoned Houses

Iona Daisy Duvet Cover Eclectic Bedroom Master Bedroom Design Duvet Covers Urban Outfitters

Tired Of Burning Money On Rent Let S Talk About How I Can Help You Stop Paying Off Your Landlord S Mortgage And Get One Of Your Own Nbsp Nbsp Whyrentwh

Mistakes While Filing Tax Return Changing Jobs Income Tax You Changed

0 Comments